Opening up a bank account in Canada for you is easy, you just have to choose which bank will give you a good offer, when you open an account with them. Go in person to the branch, bring photo ID and your SIN.

Scotia and RBC uses android app so you can install it to your phone and get access to your banking anytime anywhere.

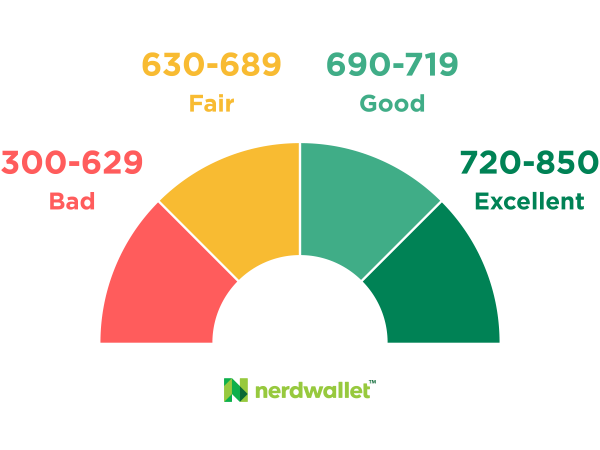

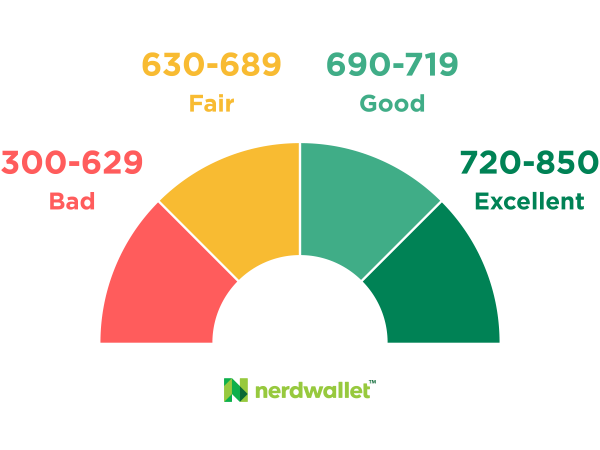

Most of the banks if they know that you are a new comer they will offer you a Credit Card to start building up your Credit Score, which will help them evaluate how good you are in managing your credit and money. Paying bills is also included in calculating credit score. So that is why be on Top of your bills and never missed payment due, this will impact how bad or good you are. You will need at least 650 score to get a mortgage, but with it you will still get a fair interest, unlike if you are in 690-800 score you will get a good mortgage rate and offer lower interest.

I will list down some of the offers on each bank

These offers are for Chequing Account

| Chequing Account | Special Feature | Fee | |

|---|---|---|---|

| Scotia One Account | 10,000 SCENE or Scotia Rewards points Sign-up bonus + Earn rewards on each transaction | $0 | |

| Tangerine No-Fee Daily Chequing | Starting at 0.15% earn interest on any balance | $0 | |

| BMO Performance Plan | Unlimited self-service transactions | $15.95 waved with $4,000 min balance | |

| TD US Daily Interest Chequing | 0.01%-0.10% from balances $1,000-$60,000 | $0 | |

| RBC Day to Day Banking | Earn 20% on Metro Points | $4 |

Chequing Account is meant for everyday transactions, like paying for gas, buying something in a store.

And these are good for Savings Account

| Bank Account | Interest Rates | Minimum Balance | |

|---|---|---|---|

| Tangerine Standard Savings | 2.75% for new clients, regular rate 1.10% | $0 | |

| Scotia Momentum Plus Savings Account | Up to 2% | $0 | |

| TD ePremium Savings | 1.05% | $10,000 | |

| RBC High Interest eSavings | 1% | $0 | |

| BMO Savings Builder | 0.2% to 1.6% | $0 |

A high interest savings account is a type of savings account that pays higher interest than standard savings accounts. And are designed to save money in for a longer period of time.

Scotia and RBC uses android app so you can install it to your phone and get access to your banking anytime anywhere.

Most of the banks if they know that you are a new comer they will offer you a Credit Card to start building up your Credit Score, which will help them evaluate how good you are in managing your credit and money. Paying bills is also included in calculating credit score. So that is why be on Top of your bills and never missed payment due, this will impact how bad or good you are. You will need at least 650 score to get a mortgage, but with it you will still get a fair interest, unlike if you are in 690-800 score you will get a good mortgage rate and offer lower interest.

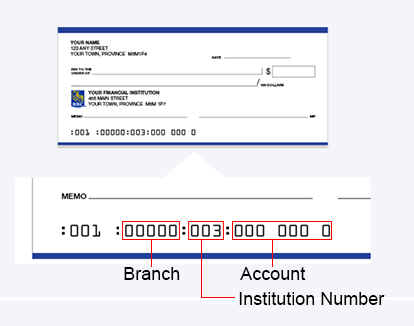

After opening up an account ask for a Void Cheque print out, you will need it when you apply for work. This is one of their requirements so they can put you in their company payroll system.

Void Cheque

contains your name, account no. branch, and institution no.

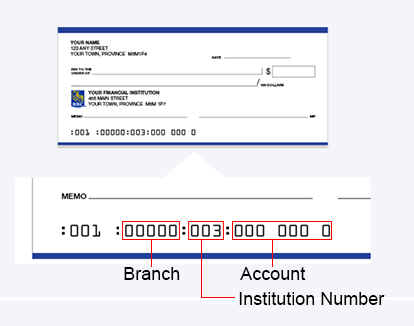

Void Cheque

contains your name, account no. branch, and institution no.